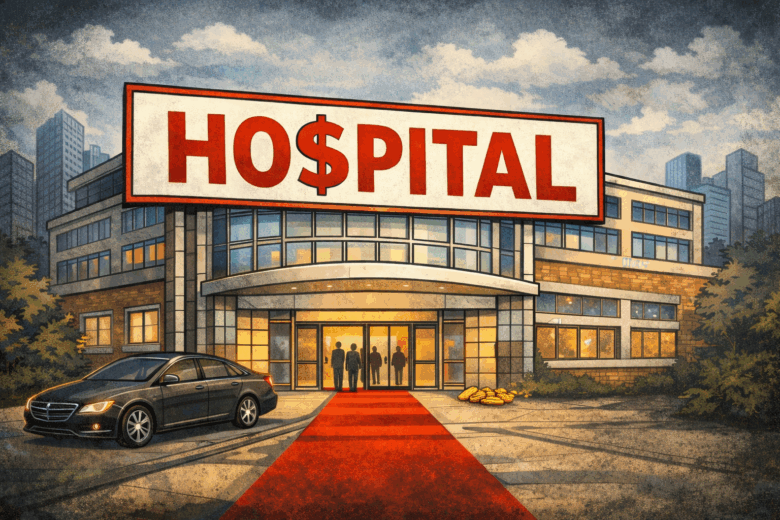

Healthcare spending in the United States has surged significantly since the Affordable Care Act became law more than 15 years ago, with hospital prices — and demands to insurance companies for higher reimbursements — far outpacing prescription drugs as the top cost driver.

Data from the Centers for Medicare & Medicaid Services show that national health expenditures climbed 7.5 percent in 2023 to nearly $4.9 trillion, continuing a long-term trend of rising costs that outpace overall economic growth.

Meanwhile, hospital spending remains the single largest slice of the nation’s healthcare bill. In 2023, according to CMS, U.S. hospital expenditures reached $1.52 trillion, growing 10.4 percent from the previous year, the fastest rate increase in decades and far above the broader health spending increase.

For years, hospitals have consistently occupied nearly one-third of healthcare costs, making even moderate year-over-year increases translate into large absolute dollar growth, according to December 2024 reporting from Health System Tracker.

Yale economist Zach Cooper blames the rise in health system consolidations over the last year for much of the increase in spending, noting that dwindling competition eliminates incentives to rein in costs. Since the early 2000s, there have been nearly 2,000 mergers among the 5,000 hospitals nationwide, he told Yale News in 2022.

“We have really good evidence that hospital competition raises providers’ quality,” Cooper said. “We also can see that hospital mergers allow hospitals to raise their prices. So, taken together, the changes we’ve seen in the U.S. hospital sector have meant weaker incentives for hospitals to improve their clinical outcomes and their prices.”

Rick Pollack, the president of the American Hospital Association, has acknowledged that “increased expenses, workforce challenges, and growing administrative burden are unsustainable and creating headwinds and obstacles that threaten access to care for millions of Americans.”

Analysts attribute the surge to higher utilization, increased patient acuity and continuing post-pandemic recoveries in care volumes, including more outpatient services and complex treatments. This rapid acceleration followed unusually slow hospital spending in 2022, when growth was just 3.2 percent, according to Fierce Healthcare.

Just recently, LCMC Health System, a nonprofit network of healthcare providers in Louisiana, wrapped up negotiations with UnitedHealthcare on a new contract. The hospital sought a 40 percent increase, which local news reported would have made the nonprofit “significantly more expensive than any health system in the New Orleans market.”

“Approximately $80 million of the $113 million LCMC is seeking would come out of the operating budgets of local employers, impacting the money they have to grow their business and compensate their employees,” a UnitedHealthcare representative told WDSU News. “We are proposing rate increases that continue to reimburse LCMC at market-competitive rates. We will remain at the negotiating table as long as it takes to reach an agreement that is affordable for Louisiana families and employers. We urge LCMC to join us there and provide a proposal they can afford.”

Two years ago in Oregon, the hospital system Legacy expressed its disappointment that Regence health insurance “elected to prematurely go public” with contract negotiations in which the hospital was also seeking a significant rate increase.

More than 30,000 Virginians sat on tenterhooks last year as Bon Secours, a Catholic healthcare system, sought to negotiate a new, multi-year agreement with Cigna that continued in-network coverage for hospitals, doctors, urgent care centers and ambulatory surgical centers. Bon Secours said Cigna’s reimbursement rates needed to keep pace with inflation, while Cigna claimed the hospital demanded an untenable 30 percent increase over five years.

And last year, Missouri hospital giant Mercy Health allegedly demanded a reimbursement rate hike of about five times the then-inflation rate in its negotiations with Anthem.

Double-digit price hikes by hospitals, occurring against a backdrop of inflation now running below 3 percent, go a long way in explaining why consumers are seeing their healthcare costs rise, though Reuters recently reported that drug prices on 350 medications will increase this year by an average of 4 percent. That comes as the pharmaceutical industry lobbies to kill a popular drug discount program known as 340B, while deflecting blame for out-of-control drug prices elsewhere in the supply chain.

Health economists offer a simple path forward: Less hospital consolidation, more competition and tougher oversight of pricing power. Until hospitals and drugmakers face real constraints on what they can charge, they argue, the forces driving healthcare costs higher will remain.

By enforcing antitrust laws, strengthening price transparency rules, and leveraging the purchasing power of public programs to put downward pressure on prices, the ability of these entities to drive up healthcare costs will be significantly reined in.