The U.S. economy faces “significant risks” due to rising federal debt, according to the nonpartisan Congressional Budget Office.

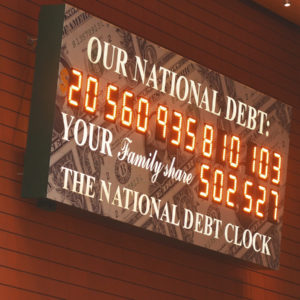

Its new economic projections warn the U.S. debt, $34.4 trillion, will reach 107 percent of the nation’s gross domestic product in five years. That’s the highest since the immediate aftermath of World War II, when America’s debt was more than 112 percent of GDP.

The CBO warned the debt-to-GDP ratio could hit a jaw-dropping 166 percent in 2054, slowing economic growth and increasing interest payments to debtholders.

“This is yet another reminder that politicians put political priorities ahead of the long-term health of the country,” said Maya MacGuineas, president of the Committee for a Responsible Federal Budget. “There is no way to look at these eye-popping numbers without realizing we need to make a change. And yet we have lawmakers promising what they won’t do: ‘I won’t raise taxes, I won’t fix Social Security, I won’t pay for all the things I do want to do.’ And so, we continue on this dangerous path.”

Federal spending ballooned during the 2007 to 2009 financial crisis but skyrocketed even higher when the coronavirus pandemic hit in 2020.

According to the CBO, healthcare was the leading cause of rising costs due to America’s aging population. Its projections said that those programs — including Social Security, Medicare an Medicaid — will hit 8.3 percent of GDP in 2054. That’s more than 50 percent of all non-interest spending in the federal budget.

Despite the depressing projections, fiscal hawks fear federal politicians have no stomach for changes.

“It’s so clear that trust fund programs and net interest are driving budget deficits and debt,” said Jason Pye, a senior policy adviser with FreedomWorks. “There’s just not much political will to solve these problems.”

The House Budget Committee voted in favor of a bipartisan fiscal commission at the behest of House Speaker Mike Johnson (R-La.). The full House has yet to vote on the proposal, but Romina Boccia of the Cato Institute hoped it would become a reality.

“Spending-based deficit reduction, especially targeted at social and entitlement programs, is most effective at sustainably reducing deficits and the growth in the debt as a percentage of GDP,” Boccia said. “While revenues are likely to be part of any politically realistic deficit-reduction proposal, legislators should focus on closing special interest loopholes that distort markets by subsidizing certain spending and investments for political preference reasons.”

The House Republican Study Committee’s recently released budget proposal included some changes to the Social Security formula. The adjustments include “modest adjustments to the retirement age for future retirees” tied to life expectancy. High-income earners would also see auxiliary benefits limited or phased out. The proposal rejected any tax hike idea because it would “further punish (people) and burden the broader economy.”

Those proposals were attacked by the Biden administration as “extreme.”

“This extreme budget will cut Medicare, Social Security and the Affordable Care Act,” said President Joe Biden. “It will shower giveaways on the wealthy and biggest corporations. Let me be clear: I will stop them.”

Presumptive Republican presidential nominee Donald Trump would like Social Security left alone.

Meanwhile, Biden’s budget increases spending to a record $7.3 trillion, nearly double the last budget under President Barack Obama ($3.5 trillion). Biden’s budget includes no entitlement reforms and would add $1.8 trillion to the debt in fiscal 2025.

Pye, with FreedomWorks, expressed dismay.

“This should be a fixable problem. But the vast majority of members of Congress are too interested in providing entertainment to the base of whichever party they belong to,” he said. “Hyper-partisan members of Congress have already paralyzed Congress. I guess they won’t be content until they fiscally paralyze the nation.”

Given Congress’s unwillingness to do its job, Mercatus Center economist Jeremy Horpedahl didn’t seem to think the government would heed the CBO’s projections.

“The sooner Congress fixes the deficit issue, the easier it is to do so, but their political incentives are to stretch it out,” he said. “Both Congress and the president have repeatedly shown us that they are unwilling to act on budget issues until the very last minute, which only compounds the problem and makes it far more dire.”